“Risk comes from not knowing what you’re doing.”

~ Warren Buffett

Let’s learn about the contracts used in trading.

Perpetual Swaps, also known as Perpetual Futures, are now fundamental instruments in crypto markets.

For those immersed in actively trading the market, these contracts present a unique way to profit on price movements.

Let’s go deeper into the concept of perpetual futures and their role in trading.

Perpetual Futures Contracts Overview

At the heart of orderflow trading lies the ability to read liquidity and the dynamics of the order book.

Perpetual futures contracts are tools that let traders bet on the future price of cryptocurrencies.

Unlike with traditional futures, perpetual futures are without expiration dates.

Their pricing is linked to the spot price of the underlying asset.

Which is the current selling or buying price of the actual asset.

Taking Positions

The Long and Short in Perpetual Trading

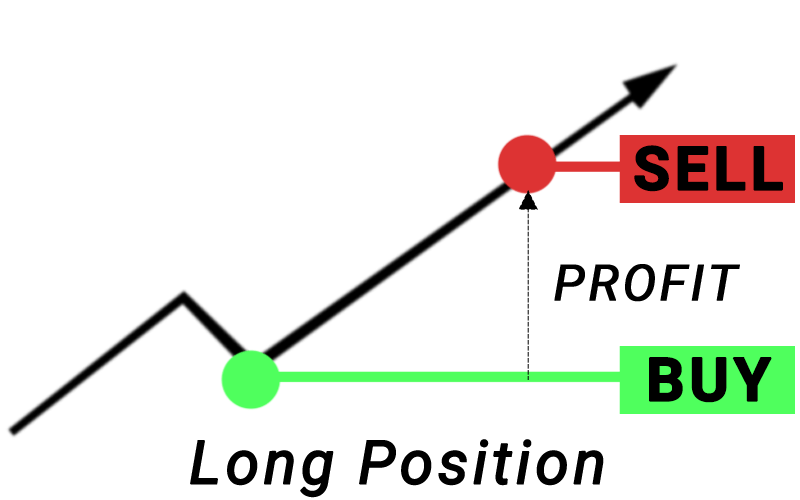

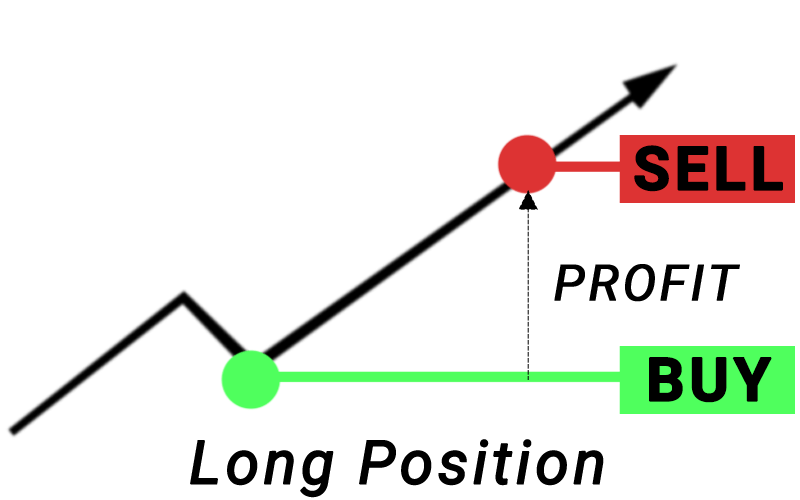

In perpetual futures trading, there are two primary positions a trader can take – long and short.

Going Long

When a trader believes the price of an asset will rise, they “go long.”

This means they’re buying the asset now with the expectation of selling it at a higher price later.

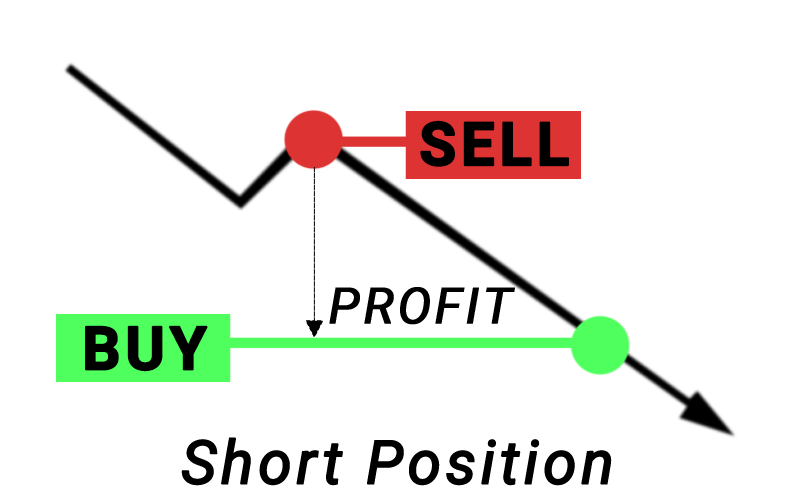

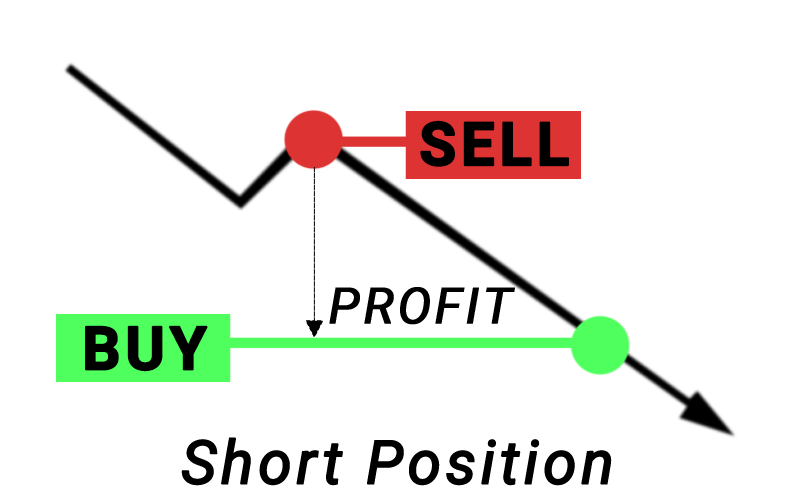

Going Short

When the trader anticipates the price will drop, they “go short.”

This involves selling the asset with the plan to buy it back at a lower price.

Linear vs. Inverse Contracts

When diving into the world of crypto trading, you’ll often come across these two types of contracts.

But what sets them apart?

Linear Contracts

Linear contracts are like your everyday shopping experience.

Think of buying a shirt priced in dollars or euros.

In the crypto world, the value of these contracts is in a fiat currency, primarily as USD ($).

Why Use Them?

They’re straightforward.

If you’re trading a linear contract and the price of the cryptocurrency goes up or down, you can easily figure out your profit or loss (PNL) in your fiat currency.

Inverse Contracts

Inverse contracts are a bit like buying a shirt priced in apples instead of dollars.

Here, the contract’s value is based on the cryptocurrency itself.

Why Use Them?

As the price of the underlying cryptocurrency changes, the value of the contract moves in the opposite direction.

Inverse contracts allow you to maintain your asset holdings while trading its position, ideal for strategies like shorting without selling the asset itself.

This can be a bit tricky to wrap your head around at first, but linear contracts offer you simplicity.

Choosing between linear and inverse contracts depends on your trading goals and comfort level.

Quick Overview

Linear Contracts

Priced and settled in a stable currency like USD. Ideal for those who want to avoid asset volatility.

Inverse Contracts

Priced in the underlying asset (e.g., Bitcoin).

Suitable for those wanting to maintain a position in the asset, especially when trading strategies like shorting.

Margining

Linear contracts are margined with USD, whereas inverse contracts are margined with the underlying asset, such as Bitcoin (BTC).

Example

As I am writing this;

The spot price of Bitcoin is $26.582,5.

The futures quote is $26.565,3.

The futures price is lower than the spot price, it might suggest that traders in the futures market are slightly more bearish about Bitcoin’s future price than those in the spot market.

This could be due to any combination of these factors:

The uncertainty of Bitcoin’s price in the future can affect its current futures price.

Costs related to holding Bitcoin, like potential interest or security costs.

Supply and Demand Dynamics

Differences in buying and selling pressures between the futures and spot markets.

Traders’ feelings and thoughts about upcoming events or changes that could affect price.

Exchanges use different ways to show the prices:

Mark Price – Think of this as a safety net price.

This is a reference price used to avoid unnecessary liquidations.

This helps to make sure traders aren’t punished due to sudden market swings.

Mark price is derived from the spot price, taking into account the funding rate.

Last Price – This represents the price at which the most recent trade occurred.

It’s a real-time view of where the market is moving and can be vulnerable to sudden price swings.

Index Price – An average price from several exchanges, giving a more stable price / value.

To keep these prices consistent, exchanges use a special system:

The Funding Rate Mechanism

In the world of perpetual futures, the “funding rate mechanism” ensures market stability with the spot market.

Here’s a more detailed look.

What is the Funding Rate?

The funding rate is a fee, either paid or received by traders, depending on the difference between the perpetual price and the spot price.

Alignment with Spot Price

The funding rate ensures that the price of the perpetual contract remains close to the underlying asset’s spot price.

If the perpetual contract is trading at a premium to the spot price;

Long positions (buyers) will pay a fee to short positions (sellers) and vice versa.

The funding rate is exchanged between traders periodically, often every 8 hours.

This means if you’re holding a position at one of these settlement times, you’ll either pay or receive the funding rate.

The funding rate isn’t fixed.

It’s based on market conditions, especially when there’s a significant gap between the contract price and the spot price.

The mechanism stops traders from keeping their positions open for long periods when the contract price is far from the spot price.

By doing so, it acts as a self-regulating system.

The funding rate mechanism is a critical tool in the perpetual futures market.

It’s the balancing force, making futures prices stay in harmony with the actual spot market prices.

Futures vs. Perpetual Futures

If you’re an orderflow trader, it’s crucial to know the differences between regular futures and perpetual futures.

Perpetual futures don’t have an end date, so traders don’t have to keep setting up their trades, making things smoother.

Ordinary futures can be settled either by actual delivery of the asset or through a financial arrangement.

Perpetual Futures don’t require any form of settlement, and can be maintained for an unlimited duration.

Perpetual swaps are anchored to the spot price of the crypto asset in question.

This alignment guarantees a consistent order flow, minimizing order book inconsistency.

While perpetual swaps come with advantages, they can be a tad more expensive due to the funding rate mechanisms.

It’s vital for traders to factor in these costs.

Once upon a time I was in a bizarre altcoin trade, I paid approximately 10% of my trading account balance in funding fees because I didn’t pay attention to the funding rate.

Now that you know how funding works, you won’t make the same mistake!

Real-World Example

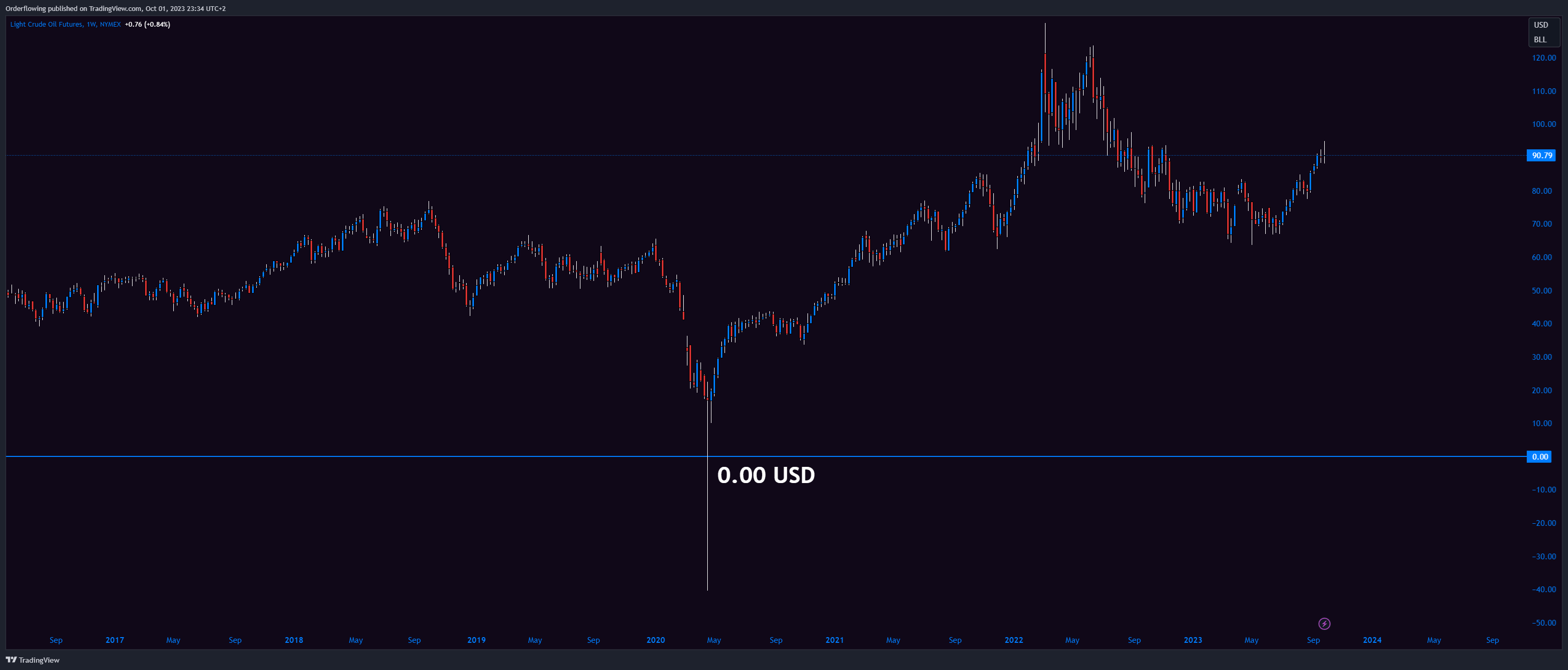

In April 2020, something crazy happened.

The price in crude oil futures (CL) dropped below zero, ending at about -$37 per barrel.

This means sellers were actually paying buyers to take the oil.

The COVID-19 pandemic reduced the demand for oil.

With so much unused oil, storage spaces were filling up fast.

Avoiding Physical Delivery

Oil futures contracts require the actual delivery of oil when they expire.

Traders didn’t want to receive oil barrels, especially with storage issues, so they tried to sell their contracts.

Travel Restrictions -> Supply and Demand

With many people not traveling by car or plane due to lockdowns, there was less need for oil.

This event shows how unexpected things can affect futures prices.

It’s a good reminder of how markets can be.

Capitalizing on the Opportunity

On the other hand, some smart traders with available storage capacity saw this as a golden opportunity.

Many called it a free trade.

Many took advantage of the negative futures prices and bought vast amounts of oil, betting on the idea that prices would rebound.

I myself took advantage and bought an index tracking the price of crude oil.

This move showcased how some traders can turn market anomalies into profitable trades.

Perpetuals – The Orderflow Perspective

Orderflow traders have an opportunity to analyze market depth and pinpointing liquidity.

Perpetual futures, provide a continuous stream of data, enabling traders to:

Expect potential price shifts based on liquidity.

Spot zones which are rich in trading volume / liquidations.

Confluence in analysing market sentiment by looking at the amount of long and short positions. As well as if they are opening or closing the positions.

The funding rate system helps traders predict how the market might move by looking at changes in money flow.

While perpetual swaps are a treasure trove of data for orderflow traders, they aren’t without challenges:

Vigilance is key.

A swift shift in order flow can trigger rapid price changes, posing a liquidation risk.

The unpredictable nature of cryptocurrencies can make it a bit tricky to analyze orderflow.

Adverse funding rates can influence trading decisions, especially for positions held for a longer period of time.

Conclusion

Perpetual futures contracts are important in cryptocurrencies.

These have carved a niche in orderflow trading within the crypto space.

Like all trading tools, it’s essential to be aware of the risks and stay ahead of market changes.

Further Reading and Resources

For you diving deeper into the world of crypto trading, it’s essential to have the right resources.

I recommend checking out reputable exchanges and platforms.

Explore More

For a curated list of valuable resources, tools, and platforms, visit Resources Page.

If you’re new to trading or need a refresher on the basics, don’t miss my beginner-friendly guide on Understanding Markets at a Basic Level.

It’s a great starting point to build a strong foundation in trading.