“There are a million ways to make money in the markets.

The irony is that they are all very difficult to find.“

~ Jack Schwager

The world of trading can be complex and intimidating, but it doesn’t have to be.

At its core, trading is all about understanding markets.

They are the very fabric of our economic system.

But what exactly is a market, and how does it create opportunities for traders?

What is a Market?

Imagine a busy marketplace where vendors are selling fruits, vegetables, and other goods.

Buyers walk around, comparing prices and quality before making a purchase.

This is a market in its simplest form — a place where buyers and sellers come together to exchange goods and services.

In the financial world, a market is not too different.

Instead of goods, people buy and sell financial instruments like stocks, bonds, and currencies.

The goal is to buy low and sell high.

— or in the case of short selling, to sell high and buy back low.

Complexity Behind Simplicity

While the concept of a market is simple, the dynamics within it are complex.

Prices fluctuate due to a countless amount of factors such as:

There are countless strategies to make money in the markets

Working out the right one is like finding a needle in a haystack.

Opportunities for Traders

So, how does understanding markets translate into opportunities for traders?

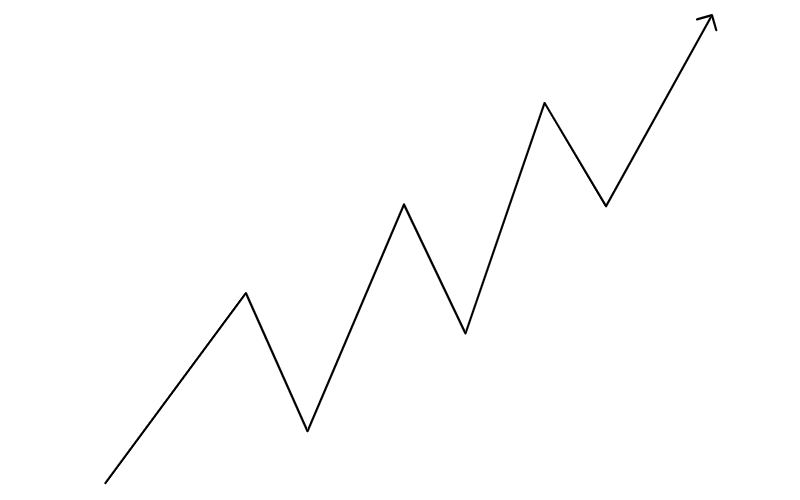

1. Identifying Trends

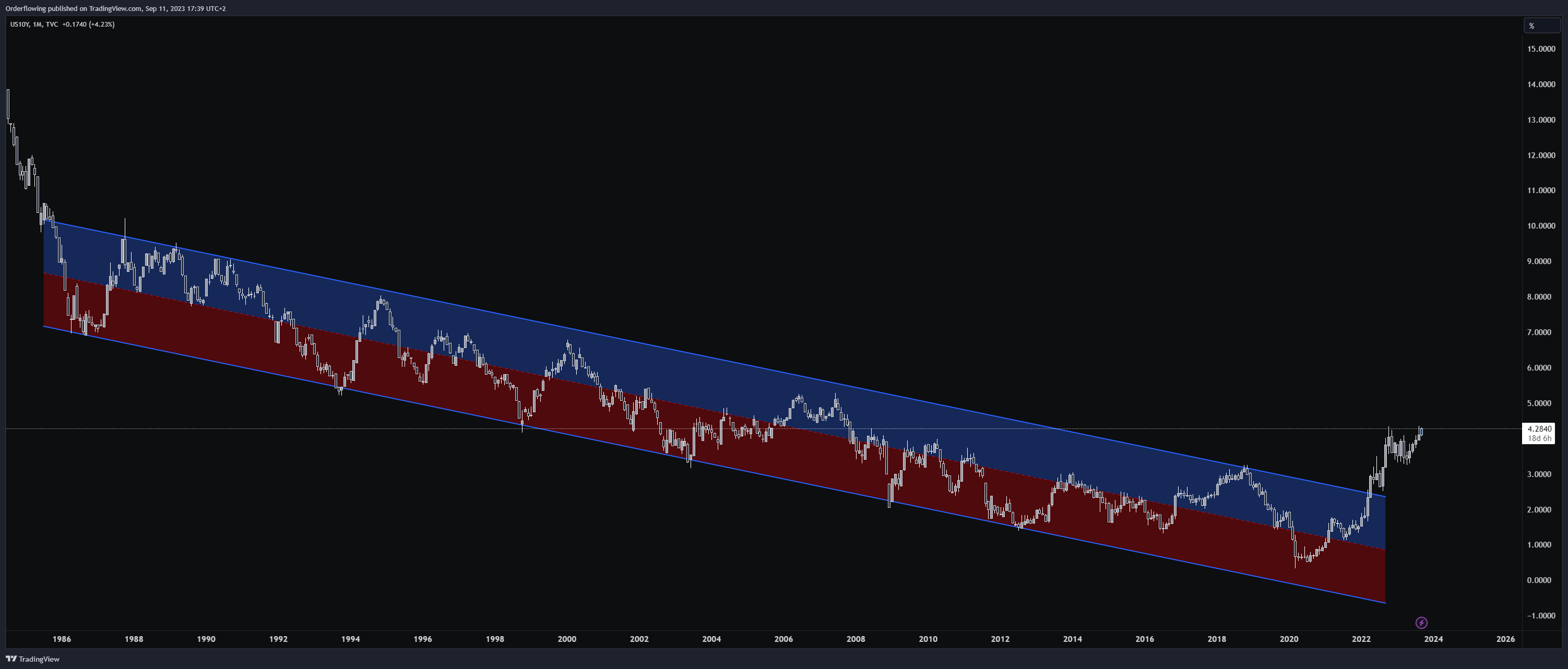

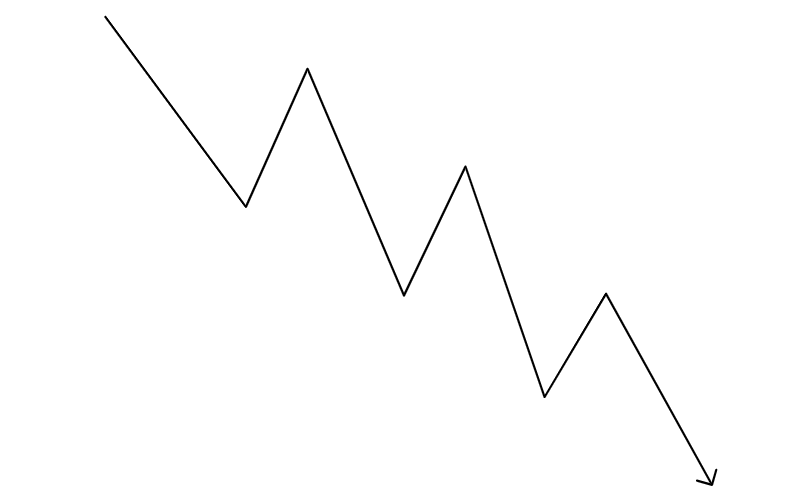

Markets often move in trends. A great chart example is of the the United States 10-Year Bond Yield:

By understanding these trends, traders can make educated guesses on where the market is headed and make bets accordingly.

Some would say that one of the most fundamental aspects of trading is the ability to identify market trends.

Trends

1. Upward (bullish).

2. Downward (bearish).

3. Sideways (neutral).

Here’s how traders can capitalize on these trends:

Bullish Trends

In an upward trend, the price of an asset reaches higher highs and higher lows.

Traders often “buy the dip,” purchasing the asset when it drops in price, anticipating that it will continue its upward trajectory.

Bearish Trends

In a downward trend, the asset’s price hits lower highs and lower lows.

Traders may “sell short” in this scenario, betting that the price will continue to go lower.

Sideways Trends

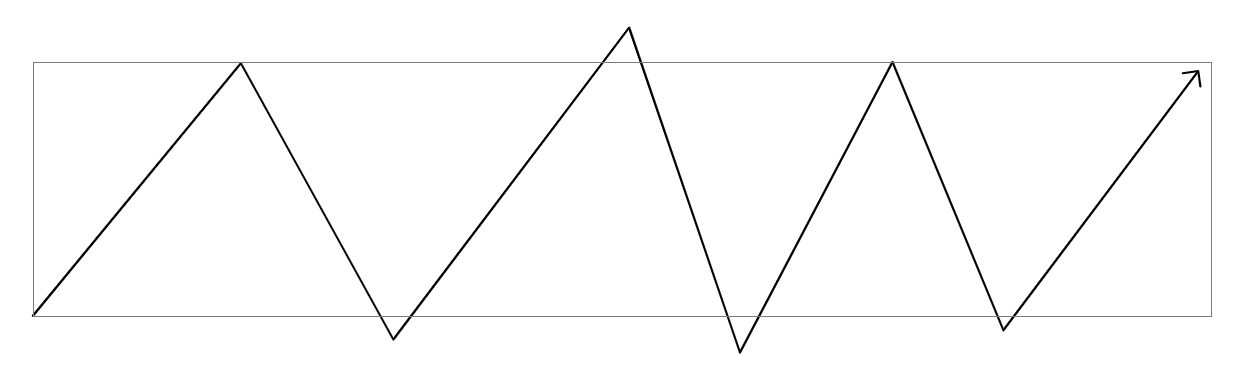

Sometimes, the market doesn’t show a clear upward or downward direction.

In such cases, traders often adopt a “wait and see” approach, holding off on major trades until a clear trend emerges.

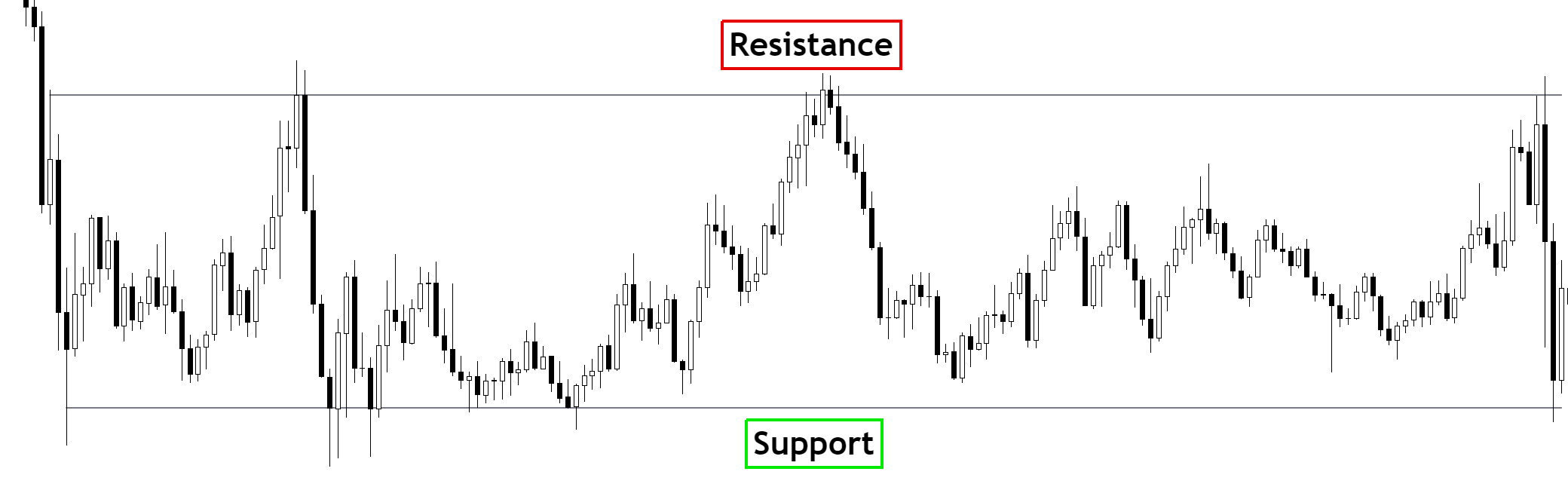

Ranges: The Sideways Strategy

Not all markets trend all the time.

Sometimes, they move sideways in a range-bound pattern.

Here, the asset’s price oscillates between a high and low point, creating a “range.”

In range-bound markets, traders identify “support” and “resistance” levels. (S/R levels).

Support is the price level where the asset tends to find interest from buyers, preventing it from falling further.

Resistance is the opposite — a price level of selling interest, stopping the price from rising further.

Buy Low & Sell High

The basic strategy in range trading is to buy near the support level and sell near the resistance level.

This approach aims to capitalize on the asset’s predictable movements within the range.

As always, risk management is crucial when trading in ranges.

Setting stop-loss orders outside the range can protect traders from significant losses in case the market breaks out of the range.

2. Arbitrage

Some traders find price differences in different markets and buy low in one market to sell high in another.

This is known as arbitrage.

Arbitrage trades in markets are typically executed by computer bots designed to find an arbitrage opportunity.

Doing this is encouraged, as it contributes to market efficiency.

These market participants also serve a useful purpose by acting as intermediaries, as they are providing liquidity in different markets.

3. Risk Management

Understanding a market also means understanding its risks.

Traders use various tools and strategies to minimize losses.

Stop-Loss Orders

One of the most straightforward ways to manage risk is by using stop-loss orders.

These are set at predetermined price levels at which a trader will sell a financial instrument to cut losses.

For example, if you buy Bitcoin at $25,000, and set a stop-loss order at $23,000.

If the price drops to this level, the asset will be sold, limiting your loss.

Position Sizing

Position sizing involves deciding how much of your total portfolio to use on a particular trade.

By diversifying your investments and not risking too much on a single trade, you can better absorb losses.

In trading, losses are guaranteed.

Leverage

Leverage allows traders to control a large position with a relatively small amount of capital.

While this can amplify profits, it can also magnify losses.

Understanding the implications of leverage and using it is crucial for risk management.

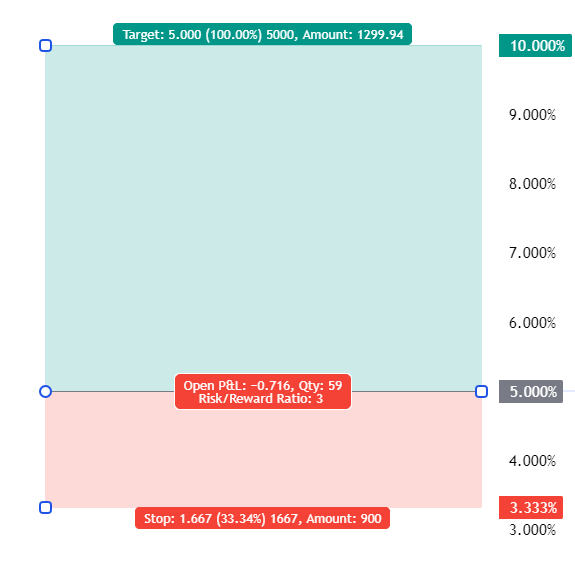

Risk-to-Reward Ratio (R)

Before entering any trade, consider the risk-to-reward ratio, which compares the potential loss of a trade to potential gain.

A favorable risk-to-reward ratio is often considered to be 1:3 R or higher.

Meaning the potential reward be at least three times greater than the risk.

Lower risk rewards are also acceptable; as long as it aligns with your strategy.

4. Diversification

Traders can diversify their portfolio to spread risk and increase the potential for profit.

Separate Accounts for Long-Term and Short-Term Investments

The standard practice is to maintain separate accounts for long-term investments and trading.

This separation allows for better risk management.

Minimal Capital on Exchanges

It’s wise to keep only the minimum amount of capital necessary for trading on an exchange.

This minimizes the risk associated with platform vulnerabilities or insolvencies, as seen in the recent bankruptcies of large financial companies like FTX.

Leverage and Risk Management

By diversifying and keeping minimal capital on exchanges, you not only reduce your exposure to various types of risk but also gain the flexibility to use leverage.

Leverage enables you to execute significant trades without tying up all your trading capital, thus optimizing your investment strategy.

The concept of ‘systematic risk’ highlights the importance of diversification as a shield against market-wide fluctuations.

Conclusion

Understanding markets is the first step in becoming a successful trader.

While the opportunities are endless, they are not easy to find.

Yet, with the right knowledge, discipline and tools, anyone can navigate the complexities of the market.