“I never use valuation to time the market. I use liquidity considerations and technical analysis for timing…The catalyst is liquidity, and hopefully my technical analysis will pick it up.”

~ Stanley Druckenmiller

This guide is designed to help you understand the concepts of technical analysis, making it easy for you and providing a solid starting point for more advanced charting.

Introduction to Technical Analysis

Technical analysis is a method traders use to evaluate assets and forecast their future movements by analyzing statistics from trading activity, such as price movement and volume.

Unlike fundamental analysis, which looks at a company’s financials and industry conditions, technical analysis only focuses on the price movements in the market.

Market Trends

Identifying market trends is a base of technical analysis, as they provide vision of the general direction of market prices.

For a refresher on understanding of the market and trends, here is the recommend reading;

Understanding Markets: The Basics of Trading.

This foundational read goes into how trends are formed and their role in trading.

The Role of Moving Averages (MAs) in Trading

Moving averages are among the most widely used tools in technical analysis, serving as the backbone of many trading strategies.

By smoothing out price data over a specified period, moving averages offer a clear view of the underlying trend, free from the distractions of short-term price fluctuations.

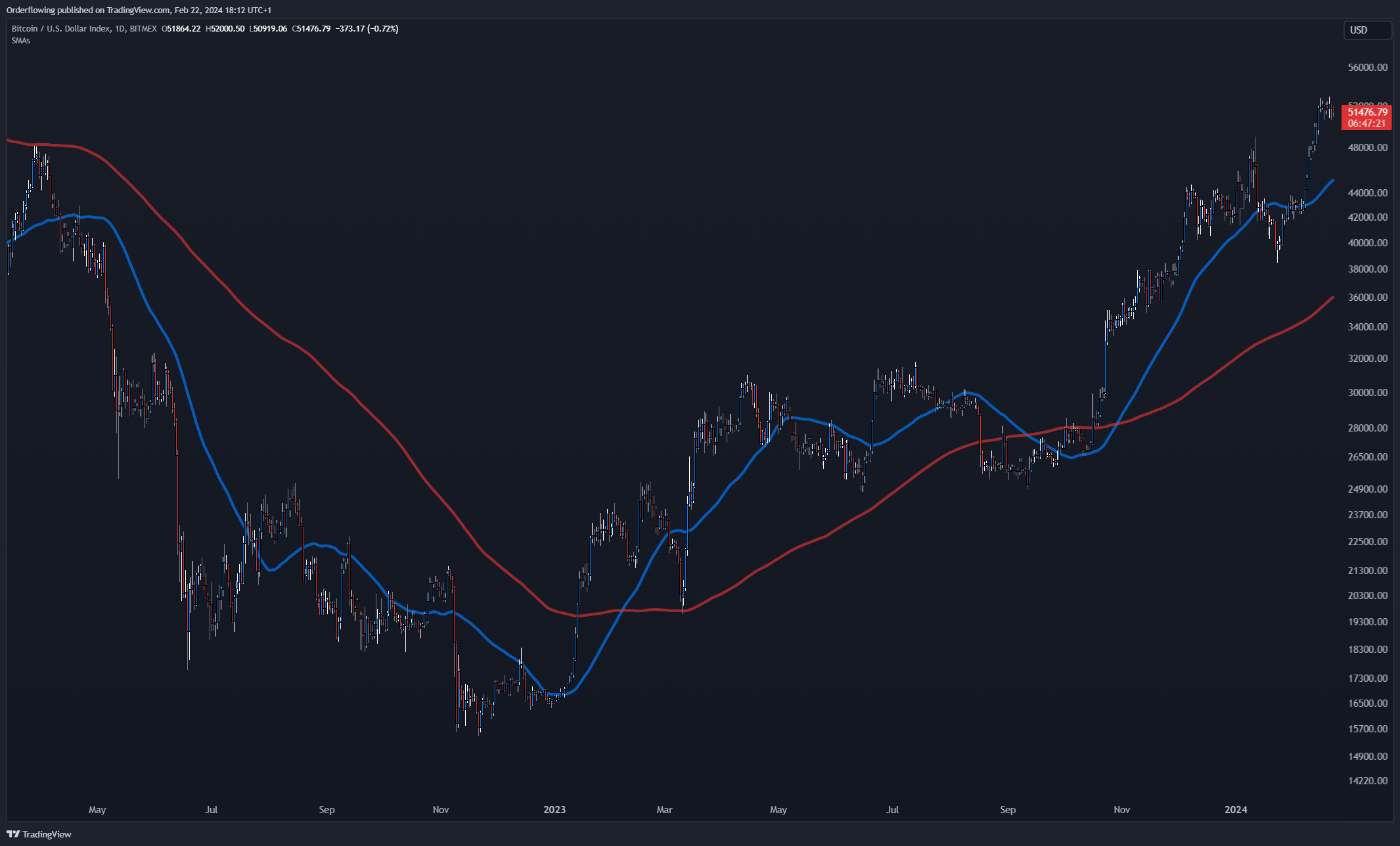

Below is an example of the 200 (Red) & 50 (Blue) “SMA” (Simple Moving Average) which is a common combination of MAs for determining the intermediate trend;

Importance of Moving Averages

Trend Identification: Moving averages help traders identify the market trend. An upward-pointing moving average suggests an uptrend, while a downward-pointing moving average a downtrend.

Support and Resistance: These averages often act as magnetic support and resistance levels. Prices tend to bounce off these moving averages, making them potential points for entry and exit decisions.

Signals: The crossover of short-term and long-term moving averages can signal potential buy or sell opportunities. For example, when a short-term moving average crosses above a long-term average, it may indicate a buying opportunity, and vice versa.

Traditional moving averages come with limitations, primarily their lagging signals.

There can be a delay in the signal they provide, which might lead to missed opportunities or late entries.

Introducing The Ribbon Trend Indicator

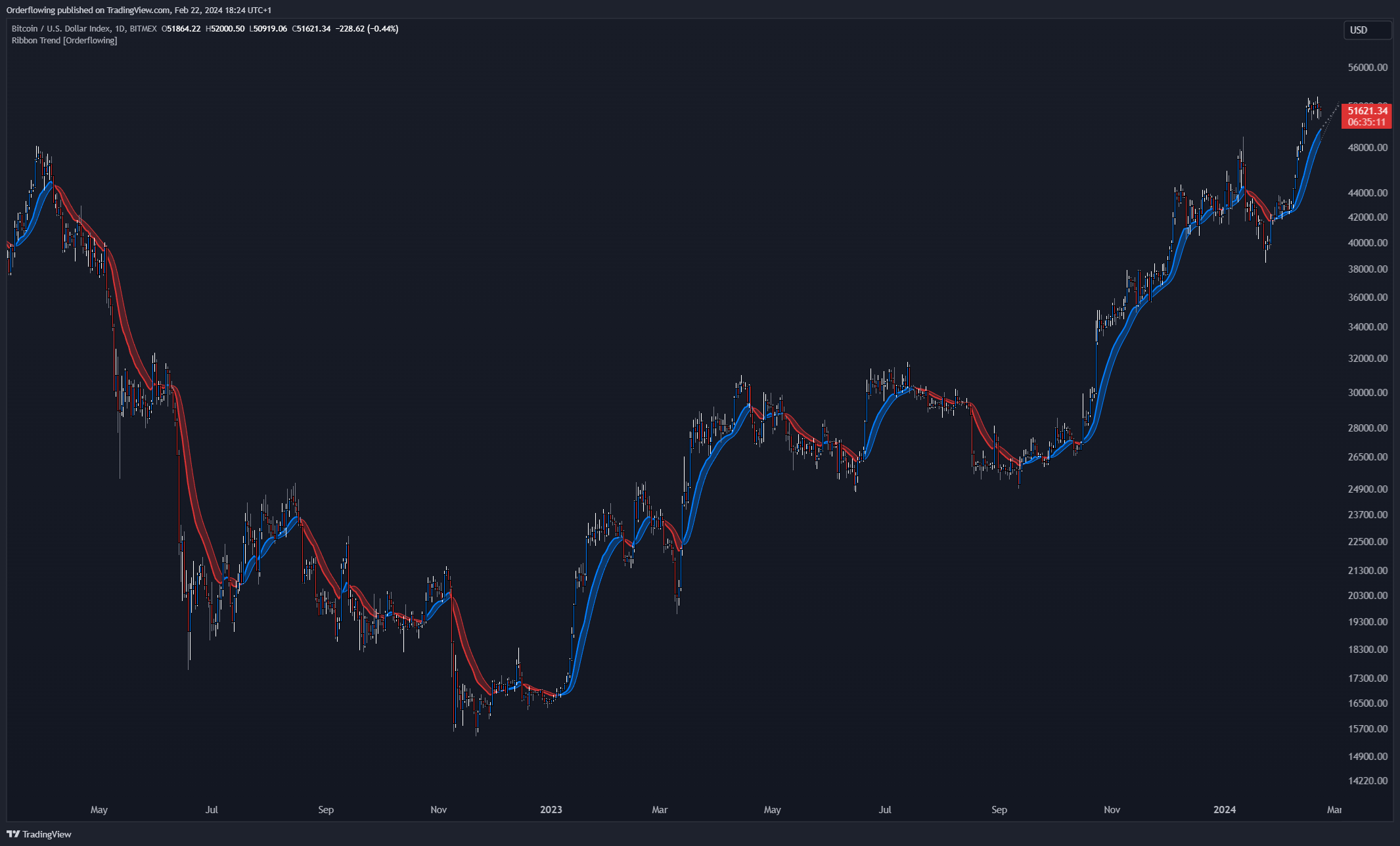

Recognizing the limitations, we sought to enhance this tool’s effectiveness. This led to the development of the Ribbon Trend Indicator, an extention of the moving average & ribbon concept. By integrating multiple moving averages with smoothing techniques, the Ribbon Trend Indicator offers a more select analysis of market trends, reducing lag and improving signal accuracy.

Advantages of The Ribbon Trend Indicator

The Ribbon Trend Indicator refines traditional moving averages by offering:

Customization: Choose from different MA types and adjust smoothing to fit your strategy.

Smoothing: Reduces noise for clearer trend identification, improving decision-making.

Visual: Color-coded signals show trend direction, just easy interpretation.

What Will You Use It For?

This tool is practical, providing timely signals for entry/exit points and risk management, crucial for aligning trades with market momentum and planning strategies effectively.

For a detailed look at the Ribbon Trend Indicator, visit its TradingView Page.

Separating Trading Tools from Strategies

Remember that trading tools, whether classic or modern, should not be mistaken for trading strategies. Tools like the Ribbon Trend Indicator are made for efficiency, refined analysis, and for support in making decisions. They are designed to add to your trading edge, reducing the time needed for analysis, but they are not replacements for the trader’s execution and discretion.

Execution

Trading User Interfaces, Indicators, and Profiles are also there to assist, not to take over the act of trading. They lack the ability to execute trades with an understanding of a human mind. While some tools may offer signaling capabilities and appear smarter by providing more accurate signals, they are not error-free sources of secret trading edges or “alpha”.

Importance of Risk Management

A tool’s effectiveness is significantly influenced by the trader’s ability to manage risk. Without a solid foundation in risk management, even the most accurate tools can lead to terrible outcomes. It’s like attempting to sell ice in Antarctica; without a strategic plan, the effort is doomed to fail, extending the trader’s road across the market fluctuations.

While tools can improve your approach, the key to sustained success lies in the strategic application of these tools, combined with disciplined risk management and the informed discretion of the trader. Remember, the craziest and most accurate tool in the hands of a novice is just a tool, but in the hands of a skilled trader, it becomes a powerful extension of their strategy.

Conclusion

Identifying trends is high-priority for investing & trading, offering judgment of market momentum and help with planning entries and exits.

The Ribbon Trend Indicator stands out as a simple yet powerful tool in this regard, offering a new version of traditional analysis methods.

Explore More

Ready to develop your trading edge with advanced tools?

See our Pricing Options & See the Indicators in Action.

Further Reading and Resources

Curated list of valuable resources, tools, and platforms, visit The Resources Page.

Don’t miss the article on Understanding Markets: Futures Contracts.