"Get Rich Slow" What They Don’t Tell You

Get Rich Slow: The Truth Behind the Illusion of “Safe” Wealth Building

Welcome to a deep dive into what we call the “Get Rich Slow” phenomenon.

A niche in finance & markets built on selling the idea of wealth through saving, extreme frugality, and a steady drip of potential future market returns.

The very foundation of this “safe and secure” strategy relies on using one powerful emotion.

Your Fear.

Fear of risk, fear of uncertainty, fear that you can’t figure out a better way.

In reality, these dreams rarely and typically never deliver for the average person.

What’s the Issue with Traditional “Get Rich Slowly”?

A guru will promise that by saving at least 10% of your paycheck, cutting back on your daily coffee from Starbucks or countless other ways to reduce spending, and sending your life savings into the S&P 500 passively managed low cost index fund, you’ll one day have the retirement of your dreams, after a few decades.

It sounds almost believable because it’s built on the surface logic of delayed gratification, which is a great principle.

You are told it’s not about earning more but about saving more and budgeting better.

The truth behind the scenes? It’s not primarily the simple investing strategy that’s making them wealthy.

It’s frustrating to watch the same scenario play out, quietly sacrificing their followers’ opportunities, time and lifestyle in the hope that a slow and painful crawl to wealth will finally pay off someday.

The Broken Idea of “Get Rich Slowly”

To understand why the advice is flawed, let’s break down what you’re being sold:

- Saving and Budgeting: Save X amount of currency and budget for 30-40 years.

- Simple Investing: Buy and hold broad market indices like the S&P 500, and hope that it generates the outlier or average % type returns for x number of years.

- Compound Interest: Believing that compounding will do all the work for you, after a lifetime of waiting.

- Get Rich Slowly… If You’re Still Here: The guru will enjoy business success, followers have to hope they’ll be around long enough for their savings to grow.

Why wait until old age to enjoy the fruits of your efforts?

Building wealth faster allows you to make the most of your prime years, instead of postponing enjoyment until retirement, especially when inflation, taxes and other expenses can “delete” those returns/gains.

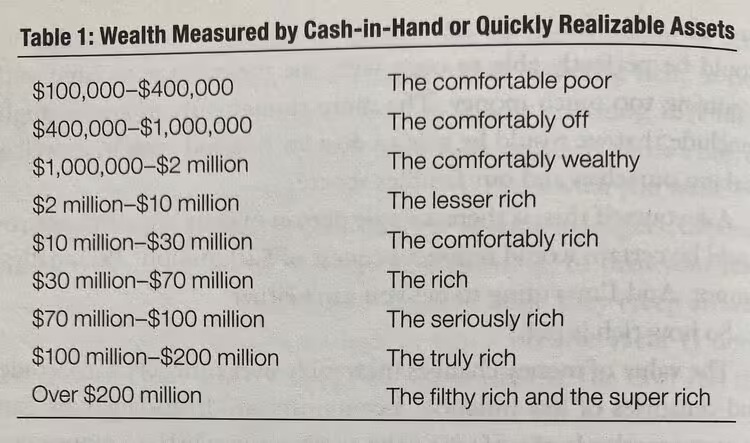

How many years of saving 10%, and growing it at the pace of inflation will it take to reach any of these stages for you?

Source: Book: How to Get Rich – Felix Dennis

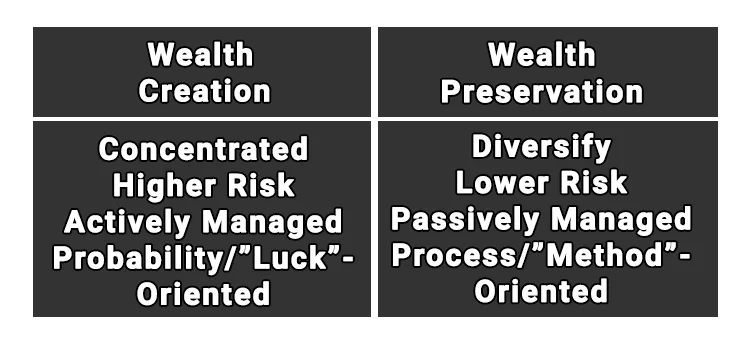

Here is the truth. The S&P 500 is for wealth preservation, not wealth generation.

It is where those who already have wealth to park in assets to keep pace with inflation, not where they build fortunes from scratch.

Yet, people keep selling this idea because it’s “safe,” it sounds logical, and it fits the average person’s risk tolerance.

They profit on the fact that you’re scared of not being in control, of failing, of losing money, and of making hard decisions. Ask yourself, who benefits?

The Different Approach

Recommended Books on Business and Life:

MJ DeMarco’s “The Millionaire Fastlane” and “Unscripted: Life, Liberty, and the Pursuit of Entrepreneurship.”

The “Get Rich Slowly” mentality as a strategy that often leads to stagnation and minimal gains over decades.

It is clear that the focus is on creating scalable businesses that can grow exponentially.

At Orderflowing, we believe that exponential growth can also be achieved through active strategies by leveraging what the trading industry has to offer.

It requires the right approach, trading can become a powerful tool for accelerating wealth when combined with effective risk management, a solid edge, and the discipline to execute consistently.

That is why we created the content & products that we have to offer, to empower traders and investors to seek more than just the “safe route” fallacy.

We don’t believe in selling you on a wealth-building strategy that takes several decades.

We believe in focusing on building, creating, and trading in ways that can generate real value—and real wealth. Within years, not decades.

The Real Motivation Behind the “Get Rich Slowly” Movement

The reason they push the “slow and steady” wealth-building narrative is because it’s easy to sell, not necessarily because it’s the best path to financial freedom.

While followers are busy cutting back on small luxuries and waiting decades for modest returns, the gurus themselves are generating wealth quickly through scalable business models.

Once they’ve built their wealth using active, high-growth strategies, they often turn around and invest that capital into the same passive index funds they recommend to everyone else.

Why? Because when you already have substantial wealth, slow, steady growth is a solid strategy for preserving the capital—not creating it.

So, what’s being presented as a wealth-building tool is actually being used for wealth management by those already ahead of the average person.

We believe it is about understanding the disconnect between what works for building wealth and what works for preserving it.

The Role of Traditional Investments – Where the Market Indices Fit In

Traditional investments like the S&P 500 and Nasdaq are not “bad” investments.

In fact, they can be highly effective financial instruments when used in the right context.

These broad market indices, along with futures contracts and other derivatives on them that allow for more dynamic trading, are valuable components of a complete financial strategy.

The key is understanding their purpose.

They are wealth preservation vehicles, not wealth generation tools for those starting out.

Why Traditional Investments Are Important – Yet Limited for Wealth Building

When you already have capital, the focus shifts from growing it exponentially to protecting it from inflation, and ultimately currency devaluation.

The S&P 500 and Nasdaq serve this role perfectly.

By investing in large, diversified companies that tend to grow steadily over time, these indices help protect your existing wealth against erosion.

For those looking to hold long-term, adding active derivatives/futures trading can further boost your portfolio returns / reduce drawdown, therefore allowing you to exercise strategic risk management.

In other words, traditional investments shine when your goal is to preserve the wealth you’ve built, not to create wealth from scratch.

That’s where many people misunderstand their function.

They see the “finfluencers” & stories of millionaires holding massive index positions and believe it is the path to wealth.

In reality, those millionaires didn’t start with index investing. They ended up there to maintain and keep safe what they’ve already achieved.

When Active Strategies Make Sense

If your goal is to build wealth quickly, relying only on broad market indices, without any leverage on your wealth equation, won’t get you anywhere other than reach the same conclusion as myself and others.

Instead, It would be wise to consider “fast-lane” strategies like:

Active Trading & Portfolio Management

Futures, options, or other derivatives trading, using active strategies allow you to compound your capital more aggressively, and the ability to use leverage (responsibly), of course provided you have developed a solid edge, use correct risk management and have discipline with your execution.

Working In a Scalable Position or Career

Roles with performance-based incentives, stock options, or profit-sharing can significantly boost your personal income (financial leverage / scale in your wealth equation) and allow your compensation to grow with the company’s success.

Building Your Own Business

Entrepreneurs and business owners don’t wait for small annual returns to build their initial wealth.

They create value, earn a return on capital and capture profit in their business, generating wealth much faster and allows for use of incredible tax optimization strategies.

Creating Digital Assets

Content creation, personal branding, and social media ventures scale quickly and can provide multiple streams of income.

For instance, if you decide to share your trading strategy using our tools, creators can earn a saleable income via our Affiliate Program.

We’re proud of this offer, since we can allow trading creators to capitalize on our business success.

Why the Wealthy Use Traditional Investments

High-net-worth individuals use investments like the S&P 500, Nasdaq, and other broad indices for a reason: they are low-maintenance, resilient to long-term market fluctuations, and help preserve what they’ve worked hard to build.

They also hedge their positions actively by using derivatives, such as futures/options contracts on these to take advantage of short-term movements or protect themselves against downside risk.

You won’t see them relying on buy and hold to build their initial wealth. That’s the critical difference.

The wealthy take aggressive, calculated risks early on—often through business ventures, active investments, or other higher risk to reward strategies, until they have enough capital to make only capital preservation the priority.

Know When and How to Use Traditional Investments

So, while we critique the “Get Rich Slowly” narrative, it’s not because the S&P 500 or Nasdaq are bad instruments.

It is because these investments are being sold as primary wealth-building tools, which they’re not.

Used correctly, they’re powerful tools for protecting your wealth against inflation and currency devaluation.

Building wealth requires a different mindset and a different set of strategies.

Once you’ve achieved significant capital, that’s when these traditional investments become useful.

Until then, focus on creating, building, and taking advantage of scalable opportunities to accelerate your path to the common goal: Financial Freedom or FIRE – (Financial Freedom Retire Early).

Breaking It Down. Reality Check for Aspiring Traders & Investors

Investing in benchmarks isn’t bad.

It’s simply misrepresented as a wealth-building tool for the average person.

Here’s why it’s flawed for those just starting out on their journey:

- Long Time Horizons: Index investing relies on 30–40-year time horizons. That’s too long for someone who’s looking to build wealth.

- Low Returns Relative to Wealth Goals: Even with a consistent moderate annual return, it takes significant capital to see impactful gains.

- Inflation Eats Your Profit: Real-world inflation eats into your returns, leaving your net growth minimal or inflation upkeep.

In contrast, faster wealth-building strategies, whichever model, can provide a much higher ROI (return on investment), with far more control over the outcomes.

These strategies require skill and effort, yes, but they also offer freedom.

Why “Get Rich Slow” Sells Well (But Doesn’t Always Work)

The reason these strategies are so widely promoted isn’t because they’re the best path to wealth, it’s because they’re easy to sell.

It’s nearly impossible to mass-produce high-income professionals overnight.

But it is possible to market a step-by-step plan that requires no specialized skills, no extra effort, and no mindset shift.

Just save more, spend less, and be patient.

The appeal is in its simplicity.

These strategies promise security and certainty, giving people a sense of control without requiring them to take on the discomfort of learning new skills or taking risks.

But the reality is that following these “safe” paths usually doesn’t lead to freedom. Instead, it traps people in a cycle of mediocrity.

Mediocrity doesn’t get you to wealth—it keeps you away from it.

Denmark’s Version of the “Get Rich Slow” Movement

Here in Denmark, the story is much the same.

Financial influencers offering money-saving tips and economic updates are promoting the same narrative of saving and passive index investing.

They come across as relatable, everyday people who’ve “cracked the code” to wealth-building through small sacrifices and steady returns.

If you open your eyes, you’ll find that their actual wealth method looks very different from the strategies they sell to you.

Most of their wealth comes not from patiently riding out decades of slow market growth, but from business and active strategies.

In other words, the very strategies they use to build their own wealth are far more active and dynamic than the passive, long-term investing methods they advocate for their audience.

It’s a familiar playbook, just with a Scandinavian twist.

From Value to Selling Out

I’ll admit—I didn’t always see these personalities for what they are now.

In fact, I used to be one of their earliest followers, genuinely interested in what they had to share.

I admired their content because it seemed relatable and practical at first.

As I watched it evolve, the focus shifted from genuinely helping the audience to simply pushing the same tired message of “learn how to save more, invest in index funds, and wait.”

It’s hard not to cringe. It’s not just a feeling of disappointment; it’s seeing people once respected prioritize profit over value.

What is painful is knowing there are people out there, who genuinely believe that these strategies are their ticket to wealth, not realizing they’re being sold a one-size-fits-all solution that rarely works as promised.

It’s frustrating, not just because these influencers are capitalizing on trust, but because the people who follow them deserve better advice, advice that takes into account both the risks and rewards of more active, faster strategies, rather than settling for a lifetime of hoping compounding alone will get them there.

The Real Road to Wealth?

If you’re serious about building wealth, understand that the Get Rich Slow idea is probably not your golden ticket.

It’s a wealth parking lot, not a racetrack.

The options include but are not limited to:

- Create Something Scalable: Whether it’s a business, physical product, a trading strategy, or a digital product, create something that can be scaled beyond just your hours worked.

- Develop High-Income Skills: Skills that produce value fast, such as coding, trading, marketing, or business development, will always outpace saving your pennies.

- Leverage Technology and Digital Markets: Today’s world allows you to scale faster than ever before. Use it!

That’s why Orderflowing was built. We’re proud to have shared the FREE knowledge folder that teaches advanced trading concepts, along with FREE trading resources to help you further beyond the illusion of “safely investing.”

We sell tools that we genuinely believe add value to a traders toolkit and that has taken months of coding and testing to develop.

Providing honest advice, high-quality resources matters more than making a quick profit.

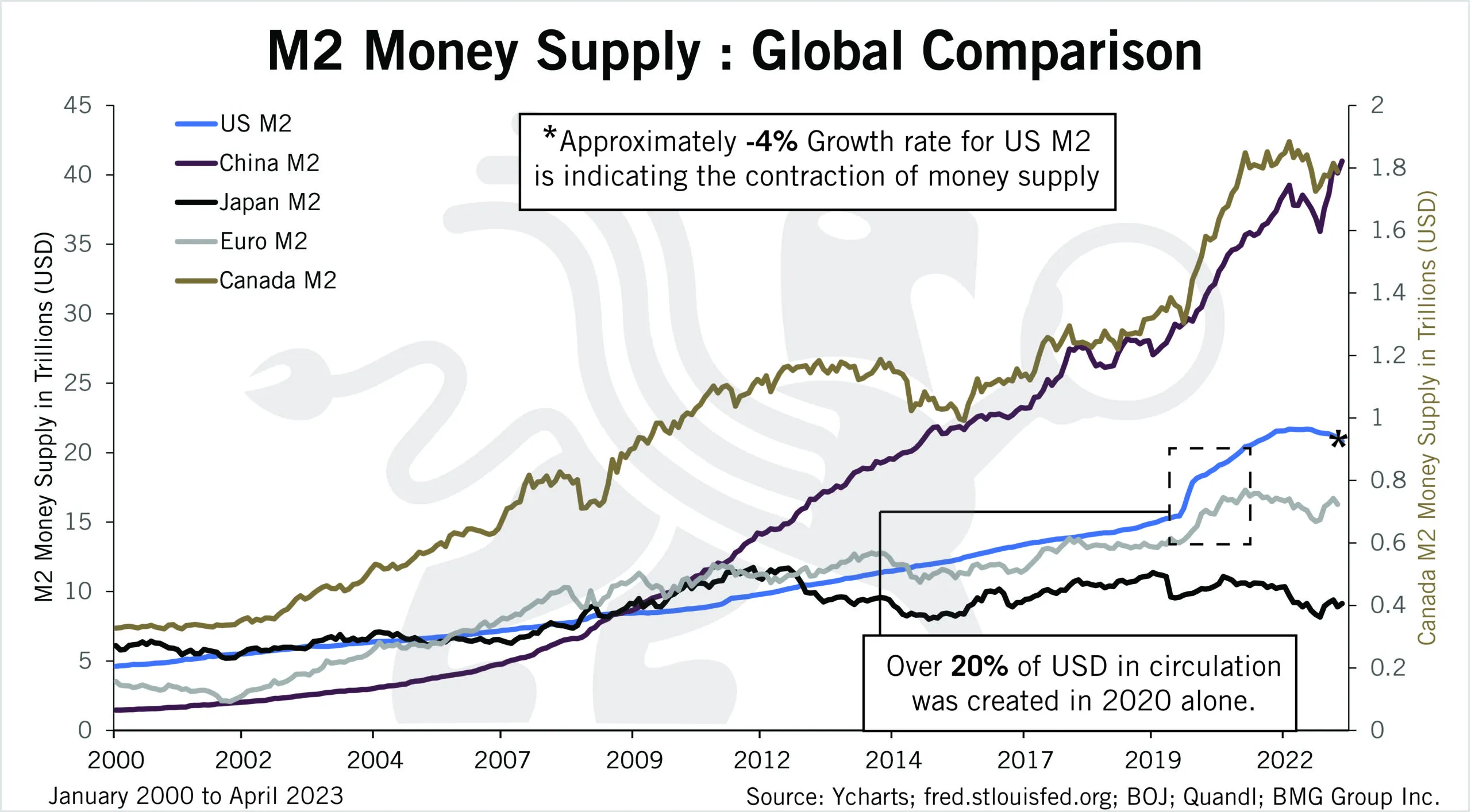

Meanwhile governments and central banks are printing billions and billions of euros, yen, yuan and dollars over time, inflation and currency debasement is outpacing the ‘safe’ investments. Others conclude that using digital currency like Bitcoin is a way to “opt out”.

Understand that there are faster paths to financial freedom than trying to save melting ice cubes in your hand.

Final Thoughts

You deserve more. You deserve the chance to create, to build, and to grow at a rate that makes a difference in your lifetime, not just for your retirement.

So, let’s stop taking advice from people who got wealthy from selling the slow path and start taking action on paths that can change our lives faster.

Because wealth isn’t just about preserving what you have—it’s about creating what you truly want.

Our Approach To Doing Business

In such a landscape, We’ve chosen commitment to honesty and transparency.

Trading and investing, at their core, are intrinsically uncertain and risky. If anyone tells you otherwise, they are lying to you.

We will only ever offer genuine value.

Orderflowing was built to help you see the market in a different way, encourages you to make your own research and decisions, and always improve your own unique approach, not to give you an illusion that success is inevitable or that following a few “easy steps” that will change your life in about 40 years.

When we offer something, it’s principles, knowledge & systems that stand on their own merit. The goal is to empower you with knowledge and tools.

We believe most knowledge can be found for free.

We believe that any product created should stand on its own merit.

It’s there to add value to your trading journey or process, not to mislead you into thinking that purchasing it will magically make you wealthy.

If you succeed, it’s because you put in the work and developed your own edge for the market, using such resources and tools as part of your firepower.

If you don’t succeed, at least be upfront about the financial, mental & other risks and individual challenges.

We believe this approach to business is ethical. We are not promising a safe, smooth road to wealth because that road doesn’t exist.

We are simply offering resources that we genuinely believe can help in this context, a trader and investor improve.

Like any other individual or business entity, profit is made when we create a return on capital or sell a product that customers find real value in, and that’s the way it should be.

Ready to learn more for completely free?

Check out our FREE Guide, FREE Blog and FREE Resources ONLY Here on Orderflowing.

Develop Edge For Markets™

We believe in approaching this with transparency and truth.

The goal isn’t to attack anyone, but to help people see through advice that may not serve their long-term interests.

“A person’s wisdom yields patience; it is to one’s glory to overlook an offense” (Proverbs 19:11)

If you’ve felt misled, we encourage you not to let it get to you, but to press forward toward your goal.

Standing up for the truth is important, but the greatest strength is in forgiveness.

Disclaimer

The content on this page is provided for educational and informational purposes only and adheres to relevant laws governing freedom of expression and public discourse under common legal frameworks. It is not intended to defame, harm, or damage the reputation of any individual, company, or entity mentioned. All opinions expressed are those of the author, based on personal experience, publicly available information, and factual analysis.

For more details on our legal policies and terms of use, please read our complete legal page.